The objective of our investment strategy is to identify promising sectors with significant added value and a positive impact on the environment. Our focus is on supporting sustainability and social responsibility. Our activities are designed to promote ecological stability and social justice.

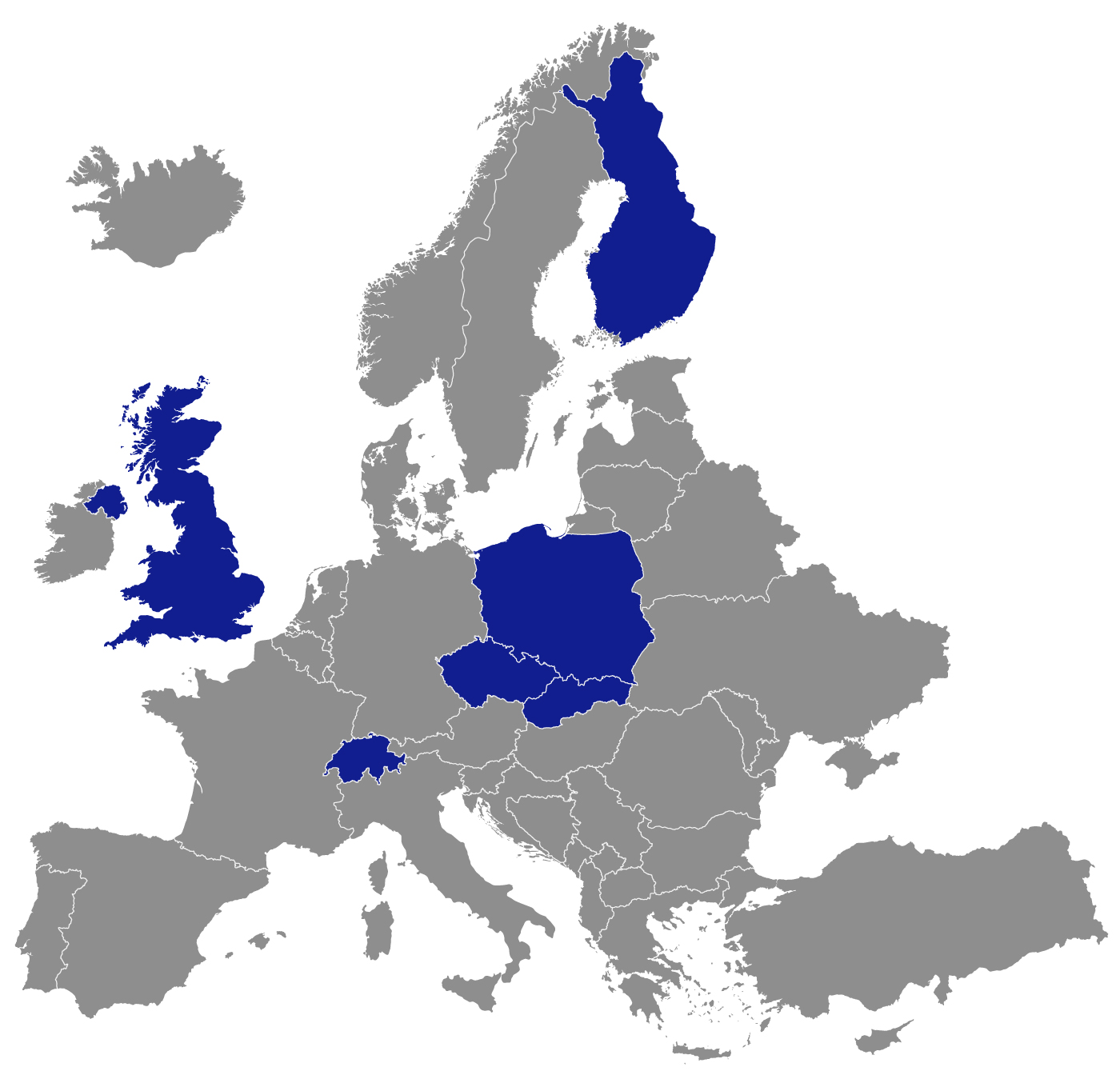

Since its establishment in 2011, Verdi Group has completed several successful projects. In the energy sector, the company co-invested in and developed wind farms in Finland with a capacity of 220 MW, which were subsequently sold to the world's largest asset manager, BlackRock.

In agriculture, the company acquired farms with a cultivated area of nearly 7,800 hectares through its regulated fund, Verdi SICAV.

Verdi Group is one of a select few fund managers in Central Europe to have introduced and continues to manage a fund of funds focused on leading global hedge funds. In 2023, the company became part of the One Family Office ecosystem, with assets under management (AUM) exceeding CZK 8.5 billion and international representation in Germany and the United Arab Emirates.